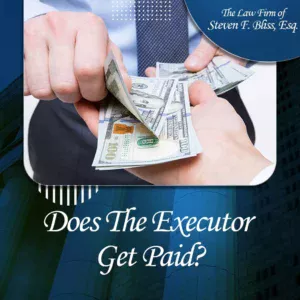

In California, the executor of an estate is entitled to compensation for the time, effort, and responsibility involved in administering the estate. Serving as an executor is a demanding role that includes managing assets, paying debts, filing taxes, and distributing property to heirs. To recognize these responsibilities, the California Probate Code provides a statutory fee schedule that determines how much an executor may be paid, based on the value of the estate.

The statutory compensation for executors is calculated as a percentage of the gross value of the probate estate, not the net. This means the calculation is based on the total appraised value of assets, regardless of debts or mortgages. The fee schedule provides four tiers: four percent of the first $100,000, three percent of the next $100,000, two percent of the next $800,000, and one percent of the next $9 million. Larger estates may involve additional compensation, subject to court approval.

The statutory compensation for executors is calculated as a percentage of the gross value of the probate estate, not the net. This means the calculation is based on the total appraised value of assets, regardless of debts or mortgages. The fee schedule provides four tiers: four percent of the first $100,000, three percent of the next $100,000, two percent of the next $800,000, and one percent of the next $9 million. Larger estates may involve additional compensation, subject to court approval.

Executors may also request “extraordinary fees” if they perform services beyond the standard duties. Examples include managing or selling real estate, handling complex tax issues, or engaging in litigation on behalf of the estate. Courts in California evaluate these requests on a case-by-case basis, considering the complexity of the work and the benefit to the estate. This provision ensures that executors are fairly compensated when estates require significant additional effort.

| Estate Value | Executor Compensation | California Rule |

|---|---|---|

| First $100,000 | 4% ($4,000) | Probate Code §10800 |

| Next $100,000 | 3% ($3,000) | Probate Code §10800 |

| Next $800,000 | 2% ($16,000) | Probate Code §10800 |

| Next $9 Million | 1% ($90,000) | Probate Code §10800 |

| Above $25 Million | Court’s Discretion | Probate Code §10800 |

An executor may choose to waive compensation, especially when serving as a family member of the deceased. Some beneficiaries prefer this approach to maximize inheritances, but it is not always practical if the estate requires significant work. Executors should carefully evaluate the responsibilities before deciding whether to waive fees, as administration often involves months or years of detailed tasks and legal compliance.

It is important to note that executor compensation is considered taxable income, unlike inheritances, which are not subject to federal income tax. Executors should plan for the tax implications of their fees and keep detailed records of their activities. In California, maintaining accurate logs of time spent and tasks completed is a best practice, especially when seeking court approval for extraordinary compensation.

In conclusion, executors in California are entitled to payment for their services under a statutory fee schedule, with additional compensation available for extraordinary duties. While some family members may waive compensation, the law ensures that executors can be fairly rewarded for their efforts. By understanding the rules, keeping records, and evaluating whether to accept or waive payment, executors can manage estates responsibly while protecting their own financial interests.